Basics

GENERAL

Version

This manual describes the contents of Cost Accounting 365 for Microsoft Dynamics 365 Business Central.

Structure of the Online help

This online help describes the functions of the areas:

- Cost Center Accounting

- Cost Unit Accounting

The online help contains the description of the individual fields as well as a process description for their use. For further information on the fields, please contact your Microsoft Dynamics partner or contact info@ckl-software.de.

COST ACCOUNTING 365

Cost Accounting Method 365 is an ISV special solution based on Microsoft Dynamics 365 Business Central® Cost Accounting 365 is an intuitive cost control tool for in-house evaluation and analysis: It provides you with quick and clear information about the revenues and costs of operation. As a dual-accounting system for classic financial accounting, this platform is available for classic operational accounting.

Classic questions about profit centres – from billing, multi-level contribution margin accounting and cost unit considerations after allocation of overheads, to the classic cost allocation sheet – can be answered in detail, analysed and considered separately.

NAVIGATION PANE

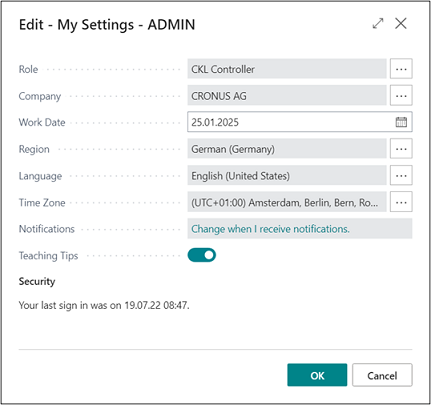

The following Role Center profiles are available for the Cost Accounting 365 solution:

- CKL Controller

The CKL Controller profile is used to provide the key information and activities via a controller’s cockpit in the Role Center.

|

|---|

| Figure Selection role CKL Controller |

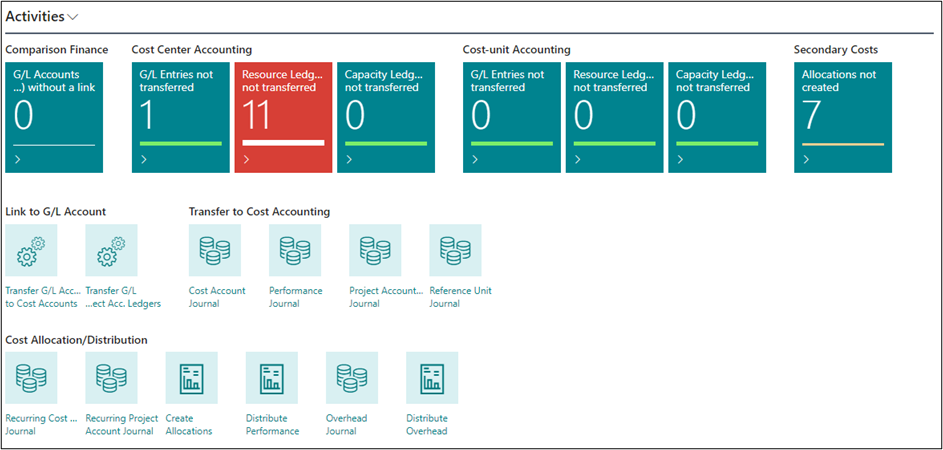

Here you can see an overview of completed or pending activities, various diagrams as well as in-dividual key figures, cost accounts and project accounts. The following areas are shown via the Controller role if all you have licensed all modules:

|

|---|

| Figure Role CKL Controller - Activities |

The following table shows the key sections or areas of the controller's Role Center:

| Name | Description |

|---|---|

| Section Activities | Shows the controller's default pending activities that need to be performed, e. g. the transfer of material, resource, and capacity entries. |

| Section Cost Accounting 365 – Performance | Shows the selected cost account schedules via the Select Chart button. For the analysis of other periods or period lengths, the period length and/or the previous and next period buttons can be used. |

| Section My Costs | Contains a list of cost account or project accounts. You can open and edit the list by clicking the List button. In addition, the target and actual costs can be analyzed within a certain period. |

| Section My Cost Accounts | Contains a list of cost accounts. You can open and edit the list by clicking the List button. In addition, the target and actual costs can be analyzed within a certain period. |

| Section My Project Accounts | Contains a list of project accounts. You can open and edit the list by clicking the List button. In addition, the target and actual costs can be analyzed within a certain period. |

| Section My Reference Units | Contains a list of reference units. You can open and edit the list by clicking the List button. In addition, the target and actual costs can be analyzed within a certain period. |

| Section My Notification | Contains a list of notifications. |

As part of the Role Centers for Cost Accounting 365, you can access new lists such as

- My Costs

- My Cost Accounts

- My Project Accounts

- My Reference Units

By using these lists, you can define relevant cost types, cost accounts, project accounts, and/or reference units, as it is the case for the “My Customers” and “My Items” lists. This way, you get a quick overview of the cost situation in your department/organization. In addition to the name, the system also shows the net changes or balances of individual areas. Furthermore, you can use the Period Length (Day, Week, Month, Quarter, Year) buttons as well as the Previous Period and Next Period buttons in all lists to perform cost analysis of certain periods. This way, you can view the costs for the respective period and analyze them in detail. The amounts and quantities within the defined cost types, cost/project accounts and/or reference units are shown depending on the options set in the "View as" (Net Change/Balance at Date) and "Period Length" (Day, Week, Month, Quarter, Year) fields. The budget values are shown based on the standard budget specified in the Cost Account Setup. In the "My Costs" section, you can add both cost accounts and projects accounts. The "Operational Amounts" and "Budgeted Amounts" are not only shown with the filters set for the "Period Length" and "View As" fields. The cost accounts and project accounts which have been added in the "My Cost Accounts" and "My Project Accounts" lists are considered here as well. The same applies for the "My Reference Units" list. Here the "Cost Quantity", "Budgeted Cost Quantity", "Project Quantity" and "Budgeted Project Quantity" fields are also shown depending on the filters specified in the "Period Length" and "View As" fields, based on the cost/project accounts specified in the "My Cost Accounts" and "My Project Accounts" sections.

BASIC SETUP

Cost Accounting 365 is a product which is fully integrated in Microsoft Dynamics 365 Business Central and which enables your company’s controlling department to perform comprehensive analyses. It provides a variety of functionalities such as flexible hierarchies, internal performance distribution or recurring postings. The integrated budgeting module enables to use traditional cost accounting methods from actual and standard to marginal costing. The flow of values both within the main modules Cost Accounting and Project Accounting as well as across modules by using debiting/crediting processes between cost accounts (global dimensions 1) and project accounts (global dimensions 2) in various ways. There are no separate tables for cost accounts and project accounts. For this purpose, the multidimensions of Microsoft Dynamics 365 Business Central have been fully integrated in Cost Accounting. This way, relevant data of your General Ledger can be automatically transferred as well as data of other systems can be integrated and further processed in Cost Accounting cost accounting via individual interfaces. By defining dimensions, you can determine additional hierarchies in Cost and Project Accounting to be used to structure your cost accounting.

Warning

Basically, the following applies to your Cost Accounting: The setup of the dimensions is freely selectable. However, a meaningful use is only guaranteed if the global dimensions are defined as follows: Cost accounts as global dimensions 1 and project accounts as global dimensions 2.

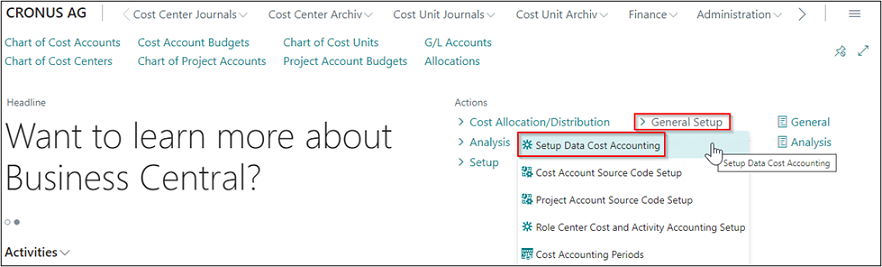

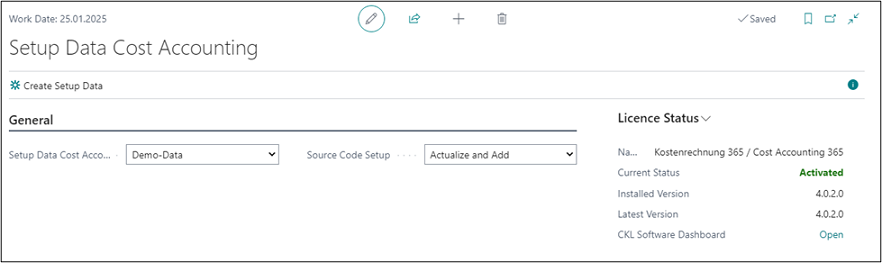

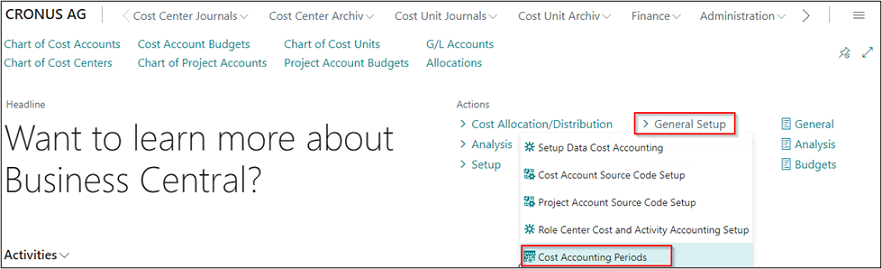

Setup Data Cost Accounting

Cost Accounting 365 is divided into the following two modules: Cost Accounting and Project Accounting. By using the basic setup, you can specify the Cost Accounting 365 setup tables in the database. The initial setup data is created in the General Setup window. For each company used in Microsoft Dynamics™ Business Central, you need to set up the fields and options in the General Setup window.

This section describes the tabs and the fields of the General Setup window. To open the General Setup window, click General Setup -> Setup Data Cost Accounting from the Actions area.

|

|---|

| Figure General Setup - Setup Data Cost Accounting |

|

|---|

| Figure Setup Data Cost Accounting |

Before you can work with Cost Accounting 365, it is required to create the initial setup data: To do this, click the Create Setup Data button. This initial setup will populate some of the setup fields with following data:

| Option | Description |

|---|---|

| Setup Data Cost Accounting | The following two options are available for this field: Demo Data: If you select this option, the company will be set up in the database with demo data. This option should only be selected in a German database using the German language setting. The company name must contain the term "CRONUS". User defined: If you select this option, the client will be set up in the database with user-defined data such as the source codes. |

| Source Code Setup | The following three options are available for this field: If table is empty: If you select this option, the company will be set up in the database with source codes if this table is empty. Add: If you select this option, source codes will be added to the database in the company. Update and Add: If you select this option, source codes will be updated and added to the database in the company. |

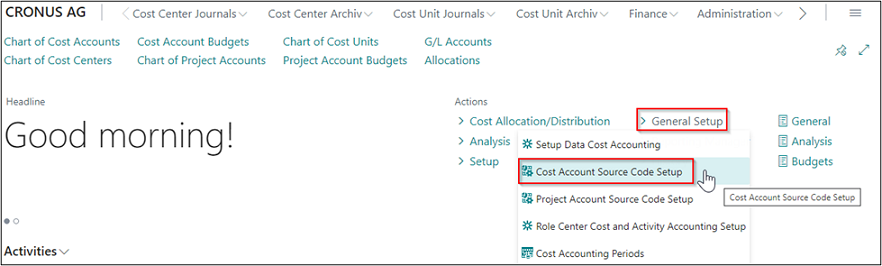

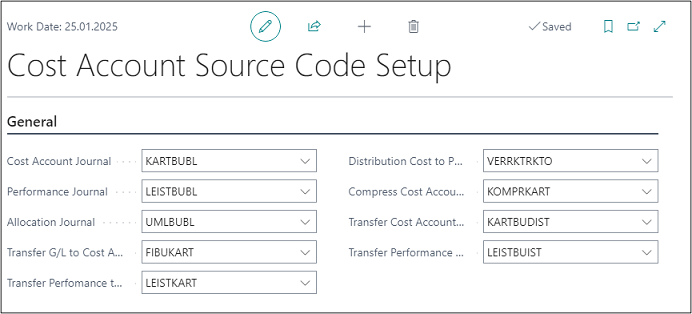

Cost Account Source Code Setup

|

|---|

| Figure General Setup - Cost Account Source Code Setup |

|

|---|

| Figure Cost Account Source Code Setup |

| Option | Description |

|---|---|

| Cost Account Journal | Specifies the code associated with entries posted from a Standard cost account journal type. |

| Performance Journal | Specifies the code associated with entries posted from a Standard performance journal type. |

| Allocation Journal | Specifies the code associated with entries posted from a Standard allocation journal type. |

| Transfer G/L to Cost Account | Specifies the code associated with entries copied from the General Ledger. |

| Transfer Performance to Cost Account | Specifies the code associated with entries with transferred quantities or performances from the Resource Planning and Manufacturing modules. |

| Distribution Cost to Proj. Acc. | Specifies the code associated with entries that copy costs to an account of project accounting. |

| Compress Cost Account Ledger | Specifies the code associated with entries generated by compressing cost account entries. |

| Transfer Cost Account Budget to Actual | Specifies the code associated with entries posted by running the Transfer Cost Account Budget to Actual batch job. |

| Transfer Performance Budget to Actual | Specifies the code associated with entries posted by running the Transfer Performance to Actual batch job. |

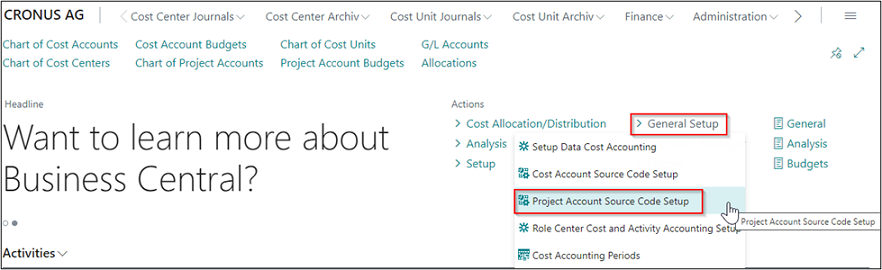

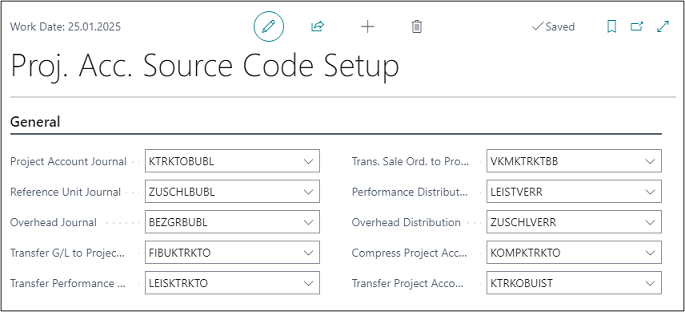

Project Account Source Code Setup

|

|---|

| Figure General Setup - Project Account Source Code Setup |

|

|---|

| Figure Project Account Source Code Setup |

| Option | Description |

|---|---|

| Project Account Journal | Specifies the code associated with entries posted from a Standard project account journal type. |

| Reference Unit Journal | Specifies the code associated with entries posted from a Standard reference unit journal type. |

| Overhead Journal | Specifies the code associated with entries posted from a Standard overhead journal type. |

| Transfer G/L to Project Account | Specifies the code associated with entries copied from the General Ledger. |

| Transfer Performance to Proj. Account | Specifies the code associated with entries with transferred quantities or performances from the Resource Planning and Manufacturing modules. |

| Transfer Sales Qty. to Proj. Account | Specifies the code associated with entries that copy sales quantities of the item for the multidimensional cost of sales method. |

| Performance Distribution | Specifies the code associated with entries posted by running the Distribute Performance batch job. |

| Overhead Distribution | Specifies the code associated with entries posted by running the Distribute Overhead batch job. |

| Compress Project Account Ledger | Specifies the code associated with entries generated by compressing the project account entries. |

| Transfer Project Account Budget to Actual | Specifies the code associated with entries that are posted by running the Transfer Budget to Actual Values batch job. |

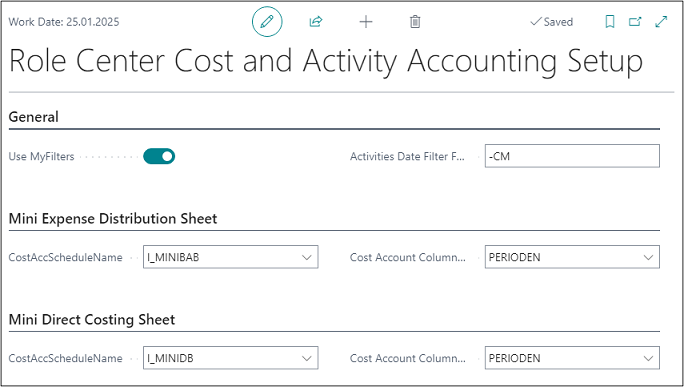

Role Center Cost and Activity Accounting Setup

In the "Role Center Cost and Activity Accounting Setup", you can specify a date for the display of key figures in the activities. This way, you can e. g. show the entries of the current month which have not been considered based on the work date and get a transparent and quick overview of the activities in the Role Center. If you want to apply these user defined lists for corresponding diagrams in the Role Center, you need to activate the "Use My Filters" field for the CKL Controller role in the Basic Setup window in the Role Center Cost Accounting 365 Setup.

|

|---|

| Figure Role Center Cost and Activity Accounting Setup |

| Option | Description |

|---|---|

| Use My Filters | Activate this field if you want to use the subsequent date filter in your Role Center for the display. |

| Activities Date Filter Formula | Enter a formula in this field to calculate the date to be applied for the display in the Activities pane. For example, you can enter the formula "-LM" (minus current month) if you want to show the data of the previous month in the batches of the activity area. |

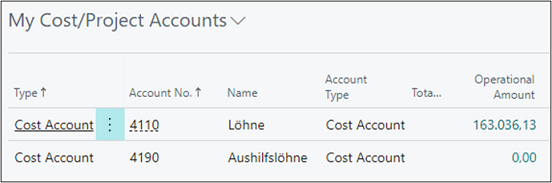

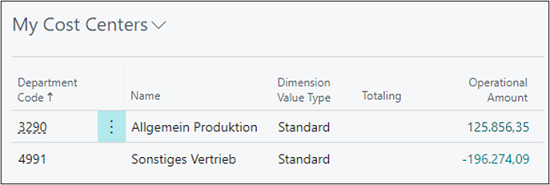

Example: You want to display the operational amount for (temporary) labor costs for the cost accounts “General Production 3290” and “Miscellaneous Sales 4991” for January 2023.

|

|---|

| Figure My Cost - Project Accounts |

|

|---|

| Figure My Cost Centers |

In this example, the "My Costs" list shows that the cost accounts 3290 and 4991. The "My Cost Centers" list, on the other hand, shows that labor costs of January 2023 only represent a small part of the total costs for cost accounts 3290 and 4991 and that they caused more costs in other areas and/or cost types.

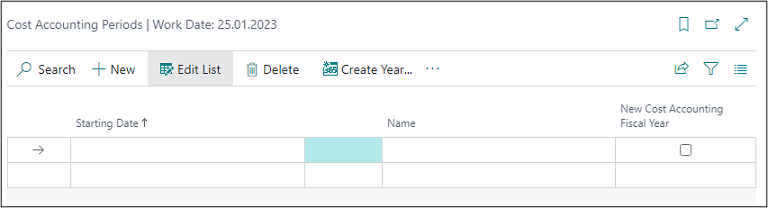

Cost Accounting Periods

|

|---|

| Figure General Setup - Cost Accounting Periods |

|

|---|

| Figure Cost Accounting Periods |

| Option | Description |

|---|---|

| Starting Date | Specifies the starting date of the accounting period. |

| Name | Specifies the name of the accounting period. |

| New Cost Accounting Fiscal Year | Indicates whether the accounting period should be used to start a fiscal year. |

SETUP

This chapter describes the setup and application of Cost Accounting 365, which can be found in the Actions area of the Setup menu.

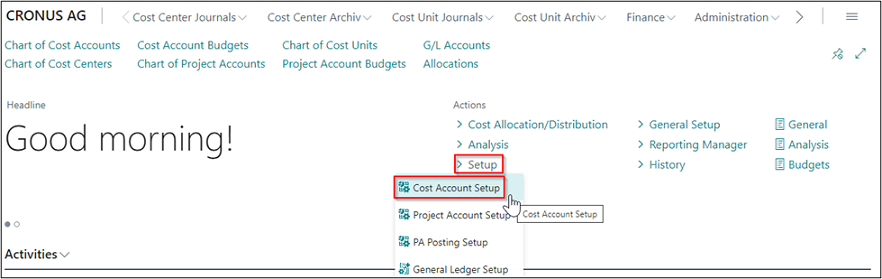

Cost Account Setup

This section describes the tabs and fields of the Cost Account Setup. To open the Cost Account Setup window, select Setup -> Cost Account Setup from the Actions area.

|

|---|

| Figure Setup - Cost Account Setup |

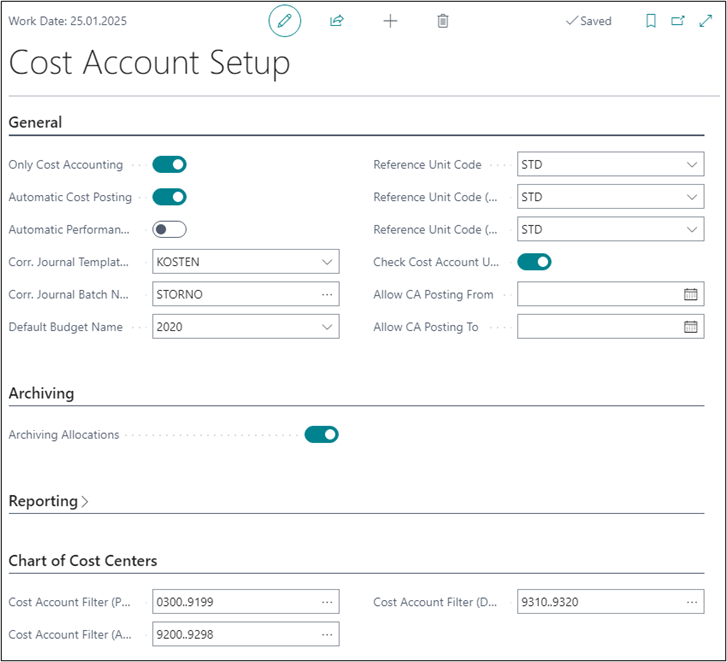

The following shows the Cost Account Setup window:

|

|---|

| Figure Cost Account Setup |

| Option | Description |

|---|---|

| General tab | |

| Only Cost Accounting | Place a check mark in this field if Project Accounting is not used and G/L postings are always to be posted to Cost Accounting (even if cost units are used to perform postings in the general ledger). |

| Automatic Cost Posting | If this field is activated, the system will also create cost account ledger entries for postings in general ledger if the corresponding dimension is specified. |

| Automatic Performance Posting | If automatic performance posting is activated, cost account ledger entries of the Performance type will be generated for quantity postings in the Resources and Manufacturing modules during posting. |

| Corr. Journal Template Name | Here you can select a template for the journal to be used for correction postings. |

| Corr. Journal Batch Name | This journal name will be used when creating correction postings. |

| Default Budget Name | The default budget name is suggested as budget for some features and reports. |

| Reference Unit Code | The reference unit code is used when transferring performances if the reference unit is not already taken from the Resources module. |

| Reference Unit Code (Setup) | The reference unit code (setup) is used when transferring performance if the reference unit for the setup time is not already taken from the Manufacturing module. |

| Reference Unit Code (Run) | The reference unit code (run) is used when transferring performance if the reference unit for the processing time is not already taken from the Manufacturing module. |

| Check Cost Account Usage | Activate this field if you want the system to check when deleting a cost account if, for example, it is used in the cost account schedules. |

| Allow PA Posting From | In this field, you can specify a starting date for a posting period from which you want to allow postings in Cost Accounting. By specifying posting periods manually, you can control your postings in Cost Accounting 365 in a flexible manner. Note: The specified periods will be ignored for automatic posting. |

| Allow PA Posting To | In this field, you can specify an ending date for a posting period to which you want to allow posting in Cost Accounting. By specifying posting periods manually, you can control your postings in Cost Accounting 365 in a flexible manner. Note: The specified periods will be ignored for automatic posting. |

| Archiving tab | |

| Archiving Allocations | If this field is activated, allocations will be archived after deletion and can be viewed in a separate table. |

| Reporting tab | |

| Acc. Sched. for Exp. Dist. Sht. | Specifies which account schedule name to use to generate the Expense Distribution Sheet report. |

| Acc. Sched. for Profit | Specifies which account schedule name to use to generate the Direct Costing report. |

| Chart of Cost Centers | |

| Cost Account Filter (Primary Cost) | Here you can specify the primary cost account types to be filtered in this column. |

| Cost Account Filter (Allocation) | Here you can specify the allocation cost account types to be filtered in this column. |

| Cost Account Filter (Distribution) | Here you can specify the distribution cost account types to be filtered in this column. |

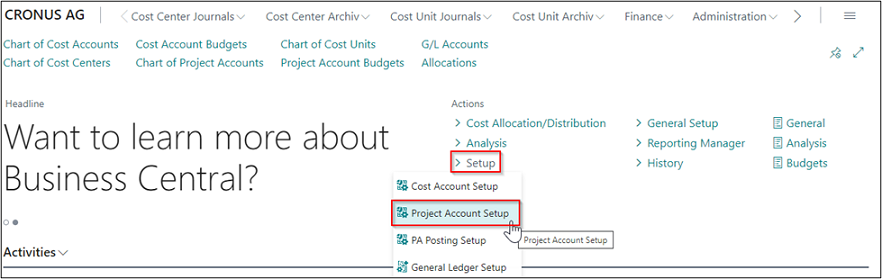

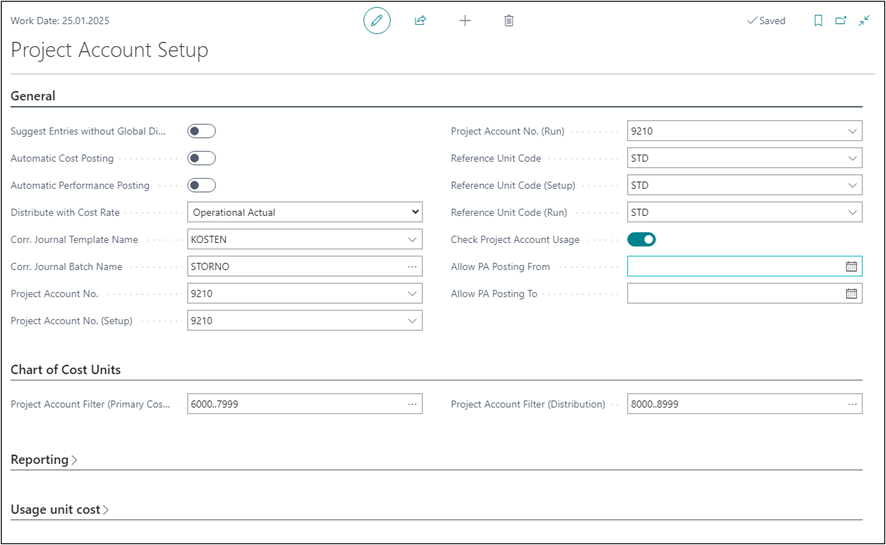

Project Account Setup

The Project Account Setup window is used to specify the basic Project Accounting settings.

|

|---|

| Figure General Setup - Project Account Setup |

The following shows the Project Account Setup window:

|

|---|

| Figure Project Account Setup |

| Option | Description |

|---|---|

| General tab | |

| Automatic Cost Posting | If this field is activated, the system will also create project account ledger entries are for postings in general ledger if the corresponding dimension is specified. |

| Automatic Performance Posting | If automatic performance posting is activated, project account ledger entries of the Performance type will be generated for quantity postings in the Resources and Production modules during posting. |

| Distribute with Cost Rate | Here you can select the rate you want to use to analyze performances in project accounting. The following options are available: Budget, Operational Actual, and Tax. |

| Corr. Journal Template Name | Here you can select a template for the journal to be used for correction postings. |

| Corr. Journal Name | This journal name will be used when creating correction postings. |

| Project Account No. | The project account no. will be used during performance transfer if the project account is not already taken from the Resources module. |

| Project Account No. (Setup) | The project account no. (setup) will be used when transferring performance if the project account for the setup time is not already taken from the Production module. |

| Project Account No. (Run) | The project account no. (run) will be used during performance transfer if the project account for the setup time is not already taken from the Production module. |

| Reference Unit Code | The reference unit code will be used during performance transfer if the reference unit for the setup time is not already taken from the Production module. |

| Reference Unit Code (Setup) | The reference unit code (setup) will be used during performance transfer if the reference unit for the setup time is not already taken from the Production module. |

| Reference Unit Code (Run) | The reference unit code (run) will be during performance transfer if the reference unit for the processing time is not already taken from the Production module. |

| Check Project Account Usage | Activate this field if you want the system to check when deleting a cost account if it is e. g. used in the cost account schedules. |

| Allow CA Posting From | In this field, you can specify a starting date for a posting period from which you want to allow postings in Project Accounting. By specifying posting periods manually, you can control the postings in Cost Accounting 365 in a flexible manner. Note: The specified periods will be ignored for automatic posting. |

| Allow CA Posting To | In this field, you can specify an ending date for a posting period to which to allow postings in Project Accounting. By specifying posting periods manually, you can control the postings in Cost Accounting 365 in a flexible manner. Note: The specified periods will be ignored for automatic posting. |

| Chart of Cost Units tab | |

| Project Account Filter (Primary Cost) | Here you can specify the primary project account types to be filtered in this column. |

| Project Account Filter (Allocation) | Here you can specify the allocation project account types to be filtered in this column. |

| Reporting tab | |

| Acc. Sched. for Profit | Specifies which account schedule name to use to generate the Direct Costing report. |

| Usage Unit Cost tab | |

| Use Parts of Standard Cost as COGS | Activate this field if you want to perform valuation based on the item’s respective consumption costs and to copy them to the individual cost accounts for material costs, capacity costs, capacity overhead costs, subcontracted costs and manufacturing overhead costs. This is done, on the one hand, by using the "Copy from Item Budget" function for the project accounts budget, and on the other hand, by using the "Transfer Sale Orders" function to apply the cost-of-sales method in Project Accounting. |

| Use Parts of Unit Cost as Resource Costs | Activate this field if you want to perform valuation based on the performance’s respective resource costs and to copy them to the direct and indirect resource costs. |

| Default Project Account No. (Sales Amount) | Here you can define a project account for the project account budget to which you want the system to copy the item budget ledger entries if the project account cannot be determined by the posting setup. If specified, the item budget ledger entries will be copied to the project account into the project account budget line by using the "Copy from Item Budget" function. |

| Default Project Account No. (COGS Amount) | Here you can define a project account for the project account budget to which you want the system to copy the item budget ledger entries if the project account cannot be determined by the posting setup. If specified, the item budget ledger entries will be copied to the project account into the project account budget line by using the "Copy from Item Budget" function. |

| Default Project Account No. (Material Cost) | Here you can define a project account for the project account budget to which you want the system to copy the item budget ledger entries if a differentiated budget distribution has been activated based on the item’s consumption costs. If specified, the budgeted quantity of the item will be valuated with the corresponding consumption costs and copied as an amount to the project account in the project account budget line by using the "Copy from Item Budget" function. |

| Default Project Account No. (Capacity Cost) | Here you can define a project account for the project account budget to which you want the system to copy the item budget ledger entries if a differentiated budget distribution has been activated based on the item’s consumption costs. If specified, the budgeted quantity of the item will be valuated with the corresponding consumption costs and copied as an amount to the project account in the project account budget line by using the "Copy from Item Budget" function. |

| Default Project Account No. (Capacity Overhead Cost) | Here you can define a project account for the project account budget to which you want the system to copy the item budget ledger entries if a differentiated budget distribution has been activated based on the item’s consumption costs. If specified, the budgeted quantity of the item will be valuated with the corresponding consumption costs and copied as an amount to the project account in the project account budget line by using the "Copy from Item Budget" function. |

| Default Project Account No. (Subcontracted Cost) | Here you can define a project account for the project account budget to which you want the system to copy the item budget ledger entries if a differentiated budget distribution has been activated based on the item’s consumption costs. If specified, the budgeted quantity of the item will be valuated with the corresponding consumption costs and copied as an amount to the project account in the project account budget line by using the "Copy from Item Budget" function. |

| Default Project Account No. (Manufacturing Overhead Cost | Here you can define a project account for the project account budget to which you want the system to copy the item budget ledger entries if a differentiated budget distribution has been activated based on the item’s consumption costs. If specified, the budgeted quantity of the item will be valuated with the corresponding consumption costs and copied as an amount to the project account in the project account budget line by using the "Copy from Item Budget" function. |

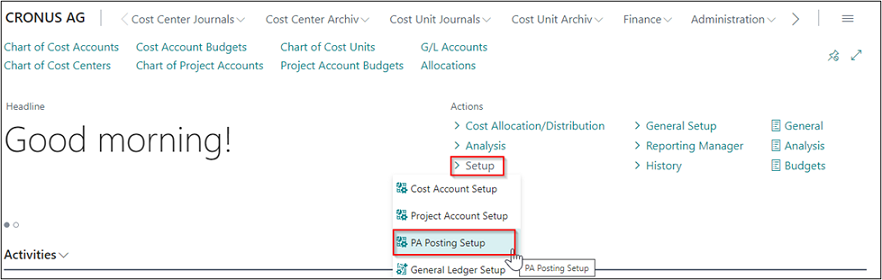

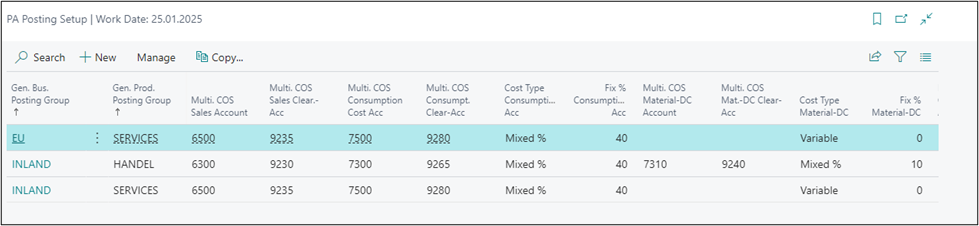

Project Account Posting Setup

In Dynamics 365 Business Central, the General Ledger posting logic regarding goods in progress is based on the cost-of-sales method. For the total cost method, material consumption and output do not show the required inventory changes. However, valuation based on the cost-of-sales method is only possible on a rough level as the costs of sales (COGS) are only available as a total and not as detail costs in the General Ledger. For this, you can use Cost Accounting 365 to create a multidimensional direct costing according based on the cost-of-sales method. “Multidimensional” means the separation into items, resources and other sales and costs. It also means the distribution of costs (COGS) into material, capacity, capacity overheads, subcontracting costs and manufacturing overheads for items. For resources, you can distribute to direct and indirect costs. For items, the determination of these five areas by the standard cost calculation is rejected and normal costs can be used instead of actual costs, as with the transfer of budget values from the item budgets. As is the case for the Posting Setup in General Leger, you can specify different or multi COS accounts of the projects chart of accounts for the combination of general business and product posting group to be used as:

- Sales account

- Consumption account (COGS for items or resource consumption)

- Material direct costs

- Capacity or resource direct costs

- Capacity or resource overhead costs

- Subcontracting direct costs

- Manufacturing overhead costs

By using further accounts as clearing accounts there is no shift to the income statement and the remaining costs can be shown as a third evaluation area. The, the created entries can be reposted by performance distributions, assignments and allocations as well as be posted, independent of the General Ledger, and made available for detailed analyses. In addition to project accounts, you can also specify the cost type of the account. Thus, performance distribution can be done by a Fix%, Variable% or Mixed%. By specifying the percentage, the posted costs will be allocated proportionately to the project account.

|

|---|

| Figure Setup - PA Posting Setup |

|

|---|

| Figure PA Posting Setup |

| Option | Description |

|---|---|

| General tab | |

| Gen. Bus. Posting Group | In this field, enter the business posting group that maps the business transaction for the cost-of-sales method. For example, you can link domestic transactions to the associated accounts of the COS method. |

| Gen. Prod. Posting Group | In this field, enter the product posting group that maps the business transaction for the cost-of-sales method. For example, you can link domestic transactions to the associated accounts of the COS method. |

| Multi. COS Revenues | |

| Multi. COS Sales Account | In this field, enter the account used to post the sales of goods according to the multidimensional COS method. |

| Multi. COS Sales Clear.-Acc | In this field, enter the clearing account used to post the sales of goods. This ensures that postings are not kept twice in the system if you also use the total cost method. |

| Multi. COS Consumption | |

| Multi. COS Consumption Cost Acc | In this field, enter the account used to post consumptions according to the multidimensional COS method. |

| Multi. COS Consumpt. Clear-Acc | In this field, enter the clearing account used to post consumptions. This ensures that postings are not kept twice in the system if you also use the total cost method. |

| Cost Type Consumption Acc | In this field, you can specify the cost type. The following 3 options are available: Fix: Consumption costs will be posted as fixed amounts. Variable: Consumption costs will be posted as variable amounts. Mixed %: The direct material costs will be posted as a mixed amount resulting from a fix percentage. The amount that exceeds the fix rate will be posted as variable amount. |

| Fix % Consumption Acc | If you select the “Mixed %” option in the “Cost Type Consumption Acc” field, enter the fix percentage rate in this field you want to use to post the consumption costs. |

| Multi. COS Material-DC | |

| Multi. COS Material-DC Account | In this field, enter the account used to post material direct costs according to the multidimensional COS method. |

| Multi. COS Mat.-DC Clear-Acc | In this field, enter the clearing account used to post material direct costs. This ensures that postings are not kept twice in the system if you also use the total cost method. |

| Cost Type Material-DC | In this field, you can specify the cost type. The following 3 options are available: Fix: Material direct costs will be posted as fixed amounts. Variable: Material direct costs will be posted as variable amounts. Mixed %: The direct material costs will be posted as a mixed amount resulting from a fix percentage. The amount that exceeds the fix rate will be posted as variable amount. |

| Fix % Material-DC | If you select the “Mixed %” option in the “Cost Type Material-DC” field, enter the fix percentage rate in this field you want to use to post the material direct costs. |

| Multi. COS Capacity-(Res.)-DC | |

| Multi. COS Capa.(Res.)-DC Acc | In this field, enter the account used to post capacity direct costs according to the multidimensional COS method. |

| Multi. COS Capa.-DC Clear-Acc | In this field, enter the clearing account used to post capacity direct costs. This ensures that postings are not kept twice in the system if you also use the total cost method. |

| Cost Type Capa.(Res.)-DC | In this field, you can specify the cost type. The following 3 options are available: Fix: Consumption costs will be posted as fixed amounts. Variable: Consumption costs will be posted as variable amounts. Mixed %: Capacity direct costs will be posted as a mixed amount resulting from a fix percentage. The amount that exceeds the fix rate will be posted as variable amount. |

| Fix % Capa.(Res.)-DC | If you select the “Mixed %” option in the “Cost Type Capa.(Res.)-DC” field, enter the fix percentage rate in this field you want to use to post the capacity direct costs. |

| Multi. COS Capacity-(Res.)-OVH | |

| Multi. COS Capa.(Res.)-Ovh Acc | In this field, enter the account used to post capacity overhead costs according to the multidimensional COS method. |

| Multi. COS Mfg.-Ovh Clear-Acc | In this field, enter the clearing account used to post capacity overhead costs. This ensures that postings are not kept twice in the system if you also use the total cost method. |

| Cost Type Capa.(Res.)-Ovh. | In this field, you can specify the cost type. The following 3 options are available: Fix Consumption costs will be posted as fixed amounts. Variable: Consumption costs will be posted as variable amounts. Mixed %: Capacity overhead costs will be posted as a mixed amount resulting from a fix percentage. The amount that exceeds the fix rate will be posted as variable amount. |

| Fix % Capa.(Res.)-Ovh. | If you select the “Mixed %” option in the “Cost Type Capa.(Res.)-Ovh.” field, enter the fix percentage rate in this field you want to use to post the capacity overhead costs. |

| Multi. COS Subcontracted-DC | |

| Multi. COS Subcontrd-DC Acc | In this field, enter the account used to post subcontracted direct costs according to the multidimensional COS method. |

| Multi. COS Subc.-DC Clear-Acc | In this field, enter the clearing account used to post subcontracted direct costs. This ensures that postings are not kept twice in the system if you also use the total cost method. |

| Cost Type Subcontrd-DC | In this field, you can specify the cost type. The following 3 options are available: Fix: Consumption costs will be posted as fixed amounts. Variable: Consumption costs will be posted as variable amounts. Mixed %: Subcontracted direct costs will be posted as a mixed amount resulting from a fix percentage. The amount that exceeds the fix rate will be posted as variable amount. |

| Fix % Subcontrd-DC | If you select the “Mixed %” option in the “Cost Type Subcontrd-DC” field, enter the fix percentage rate in this field you want to use to post the subcontracted direct costs. |

| Multi. COS Production-OVH | |

| Multi. COS Mfg.-Ovh Acc | In this field, enter the account used to post manufacturing overhead costs according to the multidimensional COS method. |

| Multi. COS Mfg.-Ovh Clear-Acc | In this field, enter the clearing account used to post manufacturing overhead costs. This ensures that postings are not kept twice in the system if you also use the total cost method. |

| Cost Type Mfg.-Ovh | In this field, you can specify the cost type. The following 3 options are available: Fix: Consumption costs will be posted as fixed amounts. Variable: Consumption costs will be posted as variable amounts. Mixed %: Manufacturing overhead costs will be posted as a mixed amount resulting from a fix percentage. The amount that exceeds the fix rate will be posted as variable amount. |

| Fix % Mfg.-Ovh Acc. | If you select the “Mixed %” option in the “Cost Type Mfg.-Ovh Acc” field, enter the fix percentage rate in this field you want to use to post the manufacturing overhead costs. |

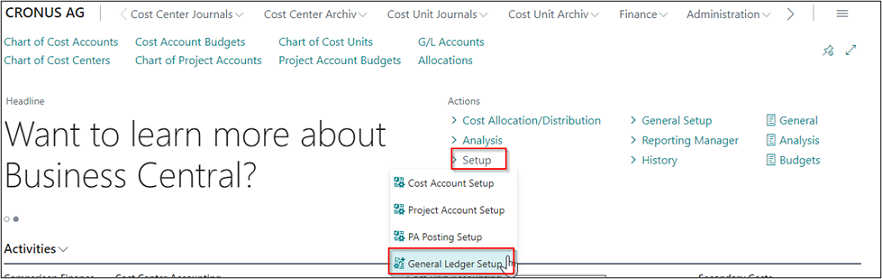

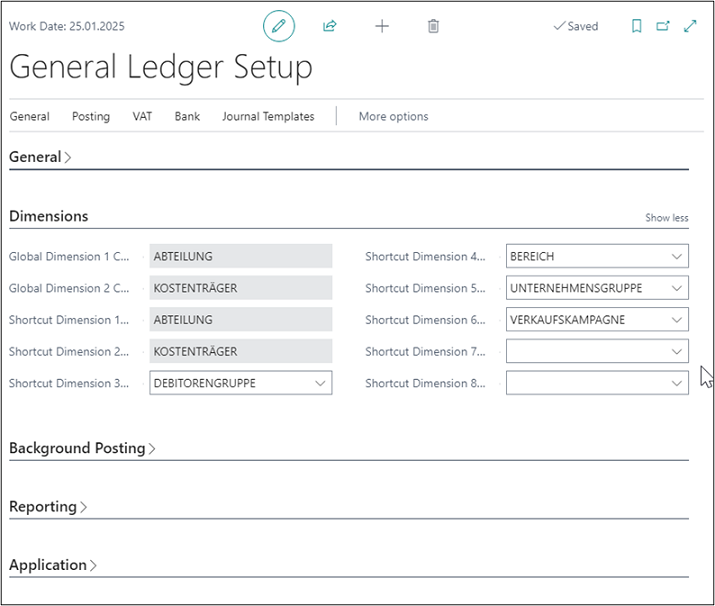

General Ledger Setup

In order to use Cost Accounting for Microsoft Dynamics 365 Business Central in a meaningful manner, you need to specify the global dimensions in the General Ledger Setup in the following way:

- Global dimension code 1 corresponds to “cost account” (as of NAV 2016 cost account has been renamed to “department”)

- Global dimension code 2 corresponds to “project account”

In this window, you can also change the settings of the global dimensions.

|

|---|

| Figure Setup - General Ledger Setup |

The following screenshot shows the General Ledger Setup window:

|

|---|

| Figure General Ledger Setup |

Warning

The global dimensions in General Ledger should only be changed if there are no postings in Cost Accounting. Once a posting has been made in the Cost Accounting or Project Accounting modules, the global dimensions should no longer be changed. If you use Cost Accounting, please consider carefully which dimensions you want to use as a cost account (department) (global dimension code 1) and as project account (global dimension code 2). If you nevertheless want to change a global dimension the effects on cost accounting should be checked in advance and, if necessary, cost accounting should be restructured for existing ledger entries.

|

|---|

| Personal support available at www.ckl-software.de/en/ |